-

What makes This important?.

-

What actions are within your capabilities?.

-

Locate What You Can Find.

What Happened.

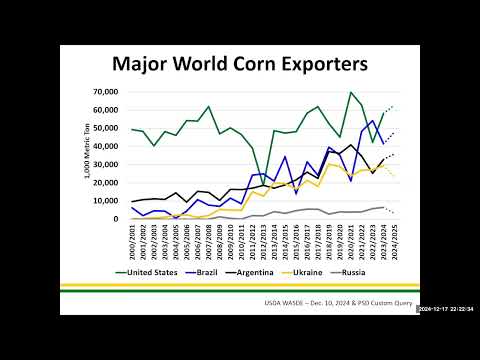

Currently, futures are trading close to $4,000. The cost of corn is not a significant concern at 40,2025. Despite the soybean price being trading near $10 on November 20, farmers are considering planting more corn acres than soybeans to pay for their bills. Would it be wise to safeguard $4 million?. What Is the best strategy or tool to use when there are two growing seasons (Southern and Northern hemispheres) ahead of final production by 2025?.

What makes This important?.

The prospect of adding 2 or 3 million acres is a negative outlook for corn prices, provided that weather conditions do not cause any adverse changes. The increase of 540 million bushels in carryout is due to the addition of 3 million and 180 bushel yield, with no other line-item changes in both supply and demand. Estimated carryout could go beyond 2 minutes. A futures harvest price of 2 billion bushels is expected to fall below the low-dollar mark of approximately $3, potentially resulting in a potential loss of $3.50. .

The most effective marketing tool may not be the one that currently resonates. If you’re considering forward selling, consider investing in call options to cover previously sold bushels. The best chance for adverse weather conditions to increase prices is through September or December calls. The cost of this may increase with time, making forward selling less appealing. .

The Short-dated call options are based on December futures and have a shorter duration. Although They may be a good option, for many, the possibility of forward contracting at the current price levels (near or below the cost of production) and buying calls (traditional or short-dated) doesn’t appeal to them. .

Despite their potential in the marketing mix, Selling futures or hedge-to-arrive contracts can still be challenging at current prices. Futures are flexible due to the absence of a marriage, so you can exit and enter as you wish.

What actions are within your capabilities?.

Sadly, given the forecast for record production in the Southern Hemisphere, there are no easy answers. Strong export performance this marketing year and potential weather conditions may lead to higher prices. At this point, it may be the most advantageous to explore options that can help establish a price threshold. .

A price threshold is established when a put is purchased. The potential for unpriced gains are endless, so investing in a put and selling an out-of-the-money call can reduce your net cost by meeting the cap on price. A window of opportunity For the strike price of the sold ca lines may be a wise choice For many. There is no limit to the risk, and taking a hedge position (short futures) at the sold strike price will result in margin calls. .

Irrespective of the strategy, which involves inaction, a risk and reward evaluation must be carried out before decision-making. Time-consuming and disciplined work is necessary when it comes to evaluating strategies. Getting started can be tough, but Once you have a plan and execute it, future decisions may be less complicated.

Locate What You Can Find.

Collaborate with experts to identify the most appropriate strategy or strategies for your particular operation. The importance of Communication lies in asking pertinent questions and obtaining a thorough comprehension of the consequences and potential benefits before acting. The objective is to arrive at judicious choices for The process, not reactive reactions to market maneuvers that are always emotional.

Editor’s Note. If you have any queries about this Perspective, reach out to Bryan Doherty at Total Farm Marketing at (800) 334-9779.

Disclaimer. The information presented here is sourced from credible sources and cannot be guaranteed. Hence, it is important to consider whether such trading is advantageous for you in light of your financial situation. The statements regarding seasonal price fluctuations or extreme market conditions are not indicative of their regularity or likelihood of happening. The seasonality of supply and demand have already been factored into Futures prices. The notion that success or profits will always be achieved through scenario planning, strategy, or discipline is not being emphasized. The decisions you make when buying, selling, or holding a futures or options position on such research are entirely your own and do not reflect Any endorsement or affiliation with Total Farm Marketing. To identify Stewart-Peterson Group incorporated8 29ExC 395 and Stewart – Petency International, Inc. (SP Risk Services LLC) as well as Total Farm Marketing and TFM?. The introducing broker Stewart-Peterson Group is registered with the CFTC and is a member of the National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. A publishing firm known as Stewart-Peterson has been established. The three companies can be linked with A customer. Unless stated otherwise, the Services mentioned in this article are those of Stewart-Peterson Group incorporated and SP Risk Services LLC.

About the Author. Bryan Doherty, who has 30 years of experience at Total Farm Marketing and a loyal following in the Grain Belt, is passionate about his clients’ success and their long-term relationships. He has a comprehensive knowledge of the tools and markets, listens attentively, and communicates with clarity to ensure clients feel at ease with the decision-making process.