Photo by Dima Solomin On Unsplash

Meta: AF ree Cash Flow Machine is an example of this

Thanks to its massive user base, robust network effects, and advancements in AI technology, Meta is a global leader in social media and digital advertising. The company is aiming to achieve long-term growth through investments in AI-powered assistants, open-source AI models, and the Reality labs. Nevertheless, there are complications caused by strict regulations, fierce competition, and changing user behavior. Is Meta a suitable addition to your portfolio?

This is not a financial advice. As a non-banking professional, I solely write these posts to share my own insights and discuss the decisions I have made. It is recommended that you conduct your own research or consult a professional financial advisor if you want to invest in any of the ideas I have put forward. The reason for this is that all investments involve a risk of loss

The Business

With over 3 million users, Meta is among the world’s most extensive online communities. The company’s apps, such as Facebook, Instagram, WhatsApp, and Messenger, allow for up to 1 billion users daily. The company’s primary source of income is digital advertising, which leverages its extensive user base and AI-driven ad targeting to help businesses reach consumers at large scale. The Family of Apps division of Meta is still highly profitable, with an operating margin of 54% in 2024, while the Reality Labs unit promotes the development of next-generation technologies such as virtual Reality and AI-powered wearable devices Through its unmatched network effects and deep integration into daily life, Meta has built a strong moat The vast number of users on its platforms, which are used for communication, entertainment, and commerce, makes it challenging to transition to other services. The ingrained user behavior of Meta strengthens its dominance, making it challenging for competitors to dilute its ecosystem. The company’s extensive data infrastructure and AI capabilities make its ad platform an essential asset for marketers seeking to maximize their return on investment. Meta is making significant investments in the future of digital interaction, but not just in advertising. The company’s Reality Labs division designs advanced computing devices, such as VR headsets, AR glasses, and AI-powered assistants like Meta A I. A lthough at present, Meta’s initiatives are not without merit as they reflect their long-term goal of creating a “virtual digital ecosystem” that could redefine how people work, socialize, and consume

Management

Mark Zuckerberg holds the positions of CEO, Chairman, and Founder at Meta , as well as its largest shareholder. Despite being a controversial figure, he is also known for his visionary thinking. Despite being founded by him at the age of 19, Facebook has grown into a multibillion-dollar enterprise in 20 years, and its impact on connecting billions of people online is still felt today. Although his tenure has been marked by events, there are several noteworthy achievements. Time Magazine recognized him as the Person of the Year, while Meta oversaw the largest tech IPO in its history in 2012, and has consistently demonstrated a willingness to make high-risk investments. His long-term dominance in the market is largely due to his strategic acquisitions of Instagram ($1 billion), Oculus ($2 billion) and WhatsApp ($19 billion). In addition to his business ventures, he has committed to philanthropy through initiatives like the Chan Zuckerberg Initiative. Mark Zuckerberg’s approval ratings as CEO have not diminished, and I find great pleasure in the fact that a company is led by its founder. Founders are often highly motivated and focused on long-term economic success, which is not the case for Mark Zuckerberg. Meta’s effectiveness as CEO is incontestable, given his performance under his leadership

The Numbers

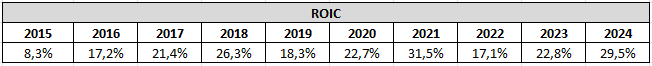

The first criterion we’ll explore is ROIC: What is the ROI for investment? The desired outcome is to witness an annual ROIC that surpasses 10% and goes up. Meta’s initial public offering occurred in 2012, and although its ROIC was acceptable initially, it began to increase rapidly from 2016 onwards. Meta’s ROIC in five out of seven years has exceeded 20%, indicating strong capital efficiency. Despite the challenging year for Meta in 2022, an ROIC of more than 10% was still within reach. The company’s resurgence led to an increase in ROIC in 2023 and 2024, with 2026 representing the second-highest level ever recorded. With a high margin, I expect Meta to maintain robust ROIC levels in the coming years

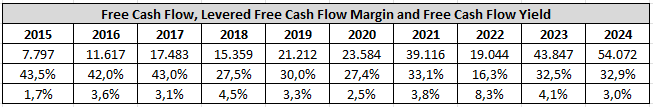

Finally, we will evaluate the amount of unrestricted cash flow Free cash flow , in short, refers to the cash that a company generates after covering its operating expenses and capital expenditures. I use Excluded net cash flow interest I think that margins provide a more comprehensive view of numbers The yield of free cash flow is a measure of net income The amount of free cash flow per share that a company is expected to generate in relation to its market value. The year-over-year growth in free cash flow of Meta was consistently consistent until 2022, making it a textbook example. However, 2022 was a difficult year, with notably reduced free cash flow. Regrettably, Meta’s turnaround was not the same as previously thought, as it reached its peak in 2023 free cash flow and surpassed it again in 2 years. The exceptional performance is a result of capital expenditures hitting their highest level in 2024. By 2025, Meta is expected to increase spending on servers, data centers, and networking infrastructure, which management sees as a strategic advantage for the future. Hence, it would not be unexpected if free cash flow decreases in 2025. Levered free cash flow has not reached its peak yet, but it is still robust at almost 33%, the second-highest level since 2017. The free cash flow yield indicates that Meta is currently trading at a higher valuation than usual, but we will revise the valuation later in the analysis

Debt

The amount of debt is another significant aspect to take into account. It is important to evaluate whether a company’s debt is manageable, and if it can be paid within three years based on its earnings. To calculate this, we divide the total long-term debt by earnings. In Meta’s case The company has just 0.46 years Earnings in debt, which means that investors are not concerned about the negative impact of debt. The fact that Meta has never had any significant debt means it is unlikely to become a problem in the future

Risks

Regulations Implicate Meta’s operations across multiple domains, posing a significant risk to the company. The company’s primary focus is on collecting and analyzing data to improve ad targeting, but the rising scrutiny of data privacy puts this core advantage at risk. The GDPR in the EU mandates stringent regulations on data protection, and breaches are punishable by fines. In the United States, California and other state laws necessitate more transparency and limit data usage, which may compromise Meta’s advertising capabilities. In addition, several countries have implemented data localization laws, such as China, India, and Turkey, which obliges firms to store user data within their own borders, leading to increased compliance costs and operational challenges. The imposition of more limitations on data transfers and processing by Meta could cause disruption to its advertising business, impact targeting accuracy, and hinder revenue growth. The dominance of Meta in social media and digital advertising is being questioned by regulators in the United States and E U. T he company has been sued by the Federal Trade Commission for anti-competitive behavior following its acquisitions of Instagram and WhatsApp. If the lawsuit is successful, Meta may have to divest these businesses, which could significantly impact its competitive position. Meta is regarded as a “gatekeeper” in the Digital Markets Act of the EU, which mandates strict controls over data usage and platform integration. The company’s ability to use its ecosystem for targeted advertising may be restricted due to this. Meta’s expansion and cross-platform data integration may be further restricted by investigations in the UK, India, and Turkey. Regulators could limit Meta’s ability to operate, integrate services, or acquire new businesses, which could hinder innovation, reduce profitability, and limit future growth. Meta has already incurred significant regulatory fines and legal challenges worth billions of dollars, and additional penalties could be severe. Previous fines that have been noteworthy include a €1 incident. A 2 billion euro (£2 billion) penalty will be imposed in 2023 for violating EU data transfer rules, and an additional $5 billion ($5 billion!) will come from the FTC in 2019 to be investigated for breaching privacy laws at Cambridge Analytica. In addition to direct fines, changing regulations demand substantial investments in legal teams, policy enforcement, and technical infrastructure, which may affect profit margins

Competition Poses a significant danger to Meta across various aspects of its business, such as user engagement, advertising, and hardware. The company’s market is undergoing rapid growth due to the combination of innovation, disruptive technologies, and changing consumer needs. Meta is facing a fierce competition from other platforms that offer alternative spaces for social interaction, content sharing, and communication. Some users are reducing their engagement with Meta’s apps due to the increasing popularity of competing platforms such as TikTok, YouTube, and Snapchat. The trend is problematic, given that Meta’s business model depends on high levels of user engagement to sustain its advertising revenue. The ability of Meta to monetize through ads is compromised if users spend less time on its platforms. Meta is in competition with Google, Amazon, and TikTok for the role of digital advertising. Some competitors, particularly Google and Apple, have more control over mobile ecosystems, which allows them to implement policies that limit Meta’s ability to collect data for ad targeting. Apple’s iOS privacy changes have had a significant impact on Meta’d measurement capabilities, leading to the company having to modify its advertising approach. If competitors continue to restrict Meta’s data access or if advertisers shift their budgets to more targeted advertising platforms, it could result in additional pressure on Meta’s ad revenue. The competition between Meta and other players in the consumer hardware and virtual reality market is growing. Apple’s Vision Pro launch is a direct competitor to Meta ‘SQ uest headsets, and larger hardware ecosystems may provide greater opportunities for adoption by companies with more diverse hardware. If Meta’s products are not differentiated or gain widespread consumer traction, its long-term investments in Reality Labs may not yield the expected returns

Failing to keep users or expand their numbers Posses a significant risk to Meta, as its business model depends upon large and highly engaged user base. The revenue generated by a company is determined by the number of active users and their engagement on different platforms. Ad impressions decrease and negatively impact Meta’s financial performance if users become less active or leave the site. The growth and engagement of Meta’s users has fluctuated, especially in markets where it has already attained high levels of usage. The influence of broader economic and geopolitical factors is also evident. The COVID-19 epidemic resulted in fluctuations in user activity, while government restrictions, such as Facebook and Instagram being banned in Russia, caused declines in certain regions. Users are highly concerned about the perceived value of Meta’s platforms. If they no longer find its services useful, trustworthy, or engaging, they may spend less time on them or leave altogether. Social networking companies that were once dominant have experienced a decline in their user base, and Meta is not exempt from this trend. The emergence of new platforms and shifts in digital consumption habits may cause users to move away from their current devices. While Meta must constantly innovate to maintain engagement, product updates that prioritize user experience can have the opposite effect. Changes to content display, the frequency or prominence of ads, and attempts to create safer, age-appropriate environments could unintentionally discourage users. The competitiveness of Meta decreases when key segments disengage, leading to a decline in the effectiveness of its advertising platform. The cascade effect is triggered by a decrease in engagement. The less active users on Meta’s platforms, the lower advertisers ‘ad revenue. The company’s ability to reinvest in innovation is restricted, which could result in a downward cycle of stagnation

Reasons to invest

Meta’s Investments in artificial intelligence Provide a compelling reason to invest in the company, given its potential impact on its products, infrastructure, and long-term revenue projections through A I. I n contrast to its competitors, Meta is integrating AI fully into its ecosystem to enhance user engagement, advertising, and future computing platforms. Meta AI, the company’s personalized assistant, is one of its most significant AI initiatives and has more users than any other AI assistant. The year 2025 is when Mark Zuckerberg believes that a highly personalized AI assistant will be able to reach more than billiards people, with Meta AI leading the way. When AI assistants reach large scale, they tend to gain a lasting advantage over time, and Meta is setting its sights on making it more personal. Meta AI differs from other AI models in that it adapts to the needs of users, their interests, and personalities, making it more relevant and engaging. Meta’s AI assistant has the potential to become a must-have for billions of users, strengthening its ecosystem and unlocking new revenue streams. Llama, an open-source AI model created by Meta, is another significant undertaking. Meta has made Llama available to developers and businesses for use, modification, and improvement, unlike most other AI models that are not kept confidential by companies. Meta’s goal with Llama 3 was to make open-source AI as powerful as closed, proprietary models. The company’s objective is to lead the development of AI with Llama 4. The open-sourcing model of Llama by Meta is aimed at increasing the number of companies and developers who use it. The more people use and improve Llama, the more advanced and efficient it becomes, creating a network effect that solidifies Meta’s position in A I. I f Llama 4 becomes the dominant AI model, Meta could become a leader in research and innovation in AI, while also benefiting from the widespread adoption of its technology. Meta’s approach to AI follows a proven strategy of creating edgy products, scaling them to gain billiards of users, and then profiting from the information. In the past, this method has been a success, and Meta is now applying the same approach to A I. D espite the fact that AI won’t be a significant revenue stream in 2025, the groundwork being laid today could lead to substantial business opportunities in the future

The division of Reality Labs at Meta Provides a sustainable return on investment as the company becomes an innovator in the next generation of computing technology. At present, Reality Labs only makes a single contribution. The management believes that 3% of Meta’s revenue is a strategic amount that could significantly shape digital interaction in the future. The recent success of Meta’s Ray-Ban Meta AI glasses demonstrates that AI-powered smart glasses could become widely used among consumers sooner than previously thought. At first, Meta believed that smart glasses would only succeed if they could display holograms and create an immersive sense of presence, but AI advancements have hastened their market penetration. The ability to see and hear user experiences enables AI assistants to provide context-aware support, making AI glasses more intuitive and interactive than smartphones. According to Meta, smart glasses could become the next major computing platform, similar to how smartphones took over desktops as the primary device for everyday computing. The adoption curve of previous breakthroughs in consumer electronics could lead to the emergence of AI-powered smart glasses, which could result in sales in hundreds, if not billions, of units over time. While the Metaverse is still in its early stages, Meta is laying the groundwork for what could potentially become a trillion-dollar market. According to Morgan Stanley, the Metaverse could be worth an $8. The market for 3 trillion addresses remains pioneered by Meta. Despite the fact that profitability is still on the rise, the company is also ramping up its Quest and Horizon users. Reality Labs, owned by Meta, is still in a financial bind, but its primary focus is on providing long-term technological superiority rather than immediate profitability. Despite the fact that AI-powered smart glasses could become widely available in the near future, there are still more potential uses for holographic AR glasses and a fully immersive Metaverse. Meta is investing heavily in its early days to establish itself as the market leader, similar to how it scaled Facebook, Instagram, and WhatsApp before fully monetizing them. Reality Labs’ potential as a major growth driver in the future could be determined by the success of AI glasses and the multi-trillion-dollar expansion of the Metaverse

The efficiency of Meta is on the rise as it becomes more profitable Is a compelling argument for investing in the company, as it boosts revenue without solely focusing on user growth. Ad placements are being streamlined by the company to ensure relevance and maintain user engagement. Meta adjusts the timing and placement of ads to ensure they are displayed at the most relevant times in an individual’s feed. Meta gains more revenue from its existing platforms by enhancing the user experience and boosting ad supply efficiency. Meta is not only upgrading its existing platforms but also expanding its monetization reach to areas that were previously unmonetized. Threads, which has a monthly active user count of over 320 million, is currently testing its ads. The revenue impact in 2025 may be modest, but the potential for long-term growth is substantial. As Time goes by, a billion users should be enough revenue to drive Threads. WhatsApp is becoming a popular messaging service among businesses, providing more avenues for advertising and commerce. Artificial Intelligence is being used by Meta to enhance its ad targeting and effectiveness. The company has recently introduced Andromeda, a machine learning system developed in conjunction with Nvidia. This system enables a 10. The complexity of ad ranking models has been raised by 1,000 times, which has significantly improved Meta’s ability to match users with the most relevant ads. The early findings indicate that ad quality has improved by 8%, leading to better performance and higher returns for advertisers. The platform’s ability to deliver more relevant ads increases engagement and enhances its value proposition for advertisers. The automation of advertising campaigns through Advantage+ is a significant area of monetization growth. With the help of AI-powered optimization, advertisers can optimize their campaigns with minimal manual labor. The adoption of Advantage+ shopping campaigns has experienced a significant increase, with an annual revenue run rate of $20 billion and achieving 70% year-over-year growth. The expansion of Meta’s advertising business is being aided by its efforts in ad optimization, AI-driven personalization, and automation, while also providing greater monetization opportunities on new platforms. The company’s efforts to maintain revenue growth are the key to making its advertising ecosystem more valuable to both users and marketers

Valuation

It is now time to compute the share price. Three different calculations that I performed after a Phil Town seminar are what I learned now. This and other stocks can be calculated by you, through the use of this link Tools page All three calculators are available for free on my website

The first is called The Margin of Safety price is a safe bet , which is calculated based on earnings per share (EPS), estimated future EPS growth, and estimated future price-to-earnings ratio (P/E). A 15% rate of return is the minimum acceptable level. I opted for an EPS of 23. The number of individuals will be 86 by 2024. The growth rate for future EPS has been set at 15% by me. According to Finbox, EPS is expected to increase by 210%. I plan to use 3% within the next five years, but 15% is my maximum usage. Moreover, I have chosen to set the P/E ratio at 30, which is twice the growth rate. The decision is based on Meta’s historically elevated price-to-earnings (P/E) ratio. Ultimately, we have established our minimum acceptable rate of return as 15%. Our calculations revealed that the sticker price, also known as intrinsic value or fair value, was $715.80. We aim to achieve a 50% safety margin, so we will divide it by 2. We are interested in purchasing Meta at a cost that is reasonable $357.90. If we consider the Margin of Safety price, it could be less or more advantageous

Another approximation is the Ten Cap price. The return on investment of a company’s owner or stockholder is quantified by the rate of return earned from its acquisition. I calculated that the operating cash flow and capital expenditures last year amounted to 78,422 and 28,882, respectively, so the minimum annual return needed to be at least 10%. I attempted to analyze their annual report to determine the percentage of capital expenditures earmarked for maintenance. Although I couldn’t find it, assuming you look at the average scenario, you can assume that 70% of capital expenditures will be spent on maintenance. The number 20,217 is what we are referring to here. The tax provision was 8,303. We have 2,534 outstanding shares. Therefore, the calculation will show that (78,422–20,217 + 8,303) /2,534 x 10 is equal to 1. $262.46 in Ten Cap price

This final calculation is called the Payback Time price. The calculation is based on the availability of cash flow per share. Meta’s net profit margin per share was $21 in 2016. With a rate of 15% growth and 42, the only way to recover your investment in 8 years is by taking advantage of the opportunity Payback Time price is $338.13.

Conclusion

The management of Meta is outstanding, and the company has numerous competitive advantages. It has maintained a high ROIC since 2016, reaching its highest level in 2024. Free cash flow reached an all-time high, and although the levered free cash Flow margin has not recovered from previous peak periods, it is still very strong at almost 33%. Regulations are a major threat to Meta’s ability to collect and process user data, which is central to its advertising business. The combination of increasing privacy laws in the United States and EU, increased data localization requirements in various countries, and antitrust scrutiny are jeopardizing Meta’s ad targeting capabilities and operational efficiency. The possibility of legal challenges, platform restrictions, and expensive compliance measures could impede profit margins and hinder future growth. The competition within Meta poses an additional major risk, as it struggles with user engagement, digital advertising, and hardware. Rivals such as TikTok, YouTube, and Snapchat are attracting younger users, which could potentially reduce engagement levels and negatively impact the ad revenue of Meta. The dominance of Apple and Google in mobile ecosystems restricts Meta’s data access, affecting its targeting capabilities in digital advertising. The competition from Apple and Microsoft in the realms of consumer hardware and virtual Reality may hinder the adoption and profitability of Meta’s Reality Labs. There is also the risk of losing users who are not returning or getting new ones, as Meta depends on a large and engaged user base for sustained revenue generation. A decrease in user activity or migration to rival websites could result in lower ad impressions, which could harm Meta’s standing and hinder future growth and innovation. Despite the risks, Meta’s deep integration of AI enhances user engagement, advertising, and future computing platforms, positioning it as a leader in A I. W ith Meta AI set to have over a billion users and Llama 4 driving open-source AI adoption, the company is setting the stage for long-term monetization and technological leadership. A long-term investment opportunity is available at Reality Labs, where Meta introduces AI-powered smart glasses and establishes the groundwork for the Metaverse. The potential for Reality Labs to become a major player in the multi-trillion-dollar market is evident from the early success of AI-driven smart glasses and the anticipated growth of the Metaverse. Meta is enhancing monetization efficiency by optimizing ad placements, targeting users with AI, and expanding monetary services to platforms like Threads and WhatsApp. Advances in artificial intelligence, such as Andromeda and Advantage+, are automating ad campaigns to improve relevance and generate new revenue streams Given that the intrinsic value of these shares has been discounted in all three of my calculations, I will make a wise investment in the long term