What factors contributed to Asian Paints ‘success in the Gattu and the Goliaths battle?

Over the past few decades, I have perused numerous business books, including biographies and success stories from prominent business figures

The majority of books that explore the unique and significant factors that propelled their startups to great heights are not as informative as some books

Despite the fact that they are not deceitful or dishonest, their success cannot be attributed to those who speak truthfully

Can I explain in detail by a specific example?

The narrative of Asian Paints::

I choose Asian Paints. As someone who has worked with their competitors for a considerable amount of time, I am well-versed in the industry and understand where they stand out

For over 50 years, Asian Paints has been THE dominant force in India’s Paint industry and is expected to remain so in THE coming years

The company is a 100% desi grown start up that has faced competition from the International Goliath Empire in the past

The Goliaths were not children’s play, as they were all international giants with pure blue blood

What was the process used by Asian Paints to create their products?

What Were the deliberate decisions that enabled them to overcome these Goliaths? Were they intentional?

The tales in the accessible literature challenge you to believe that the Choksi Brothers’ leadership and vision were the driving forces behind it, highlighting Asian Paints ‘first TV commercial launch, impressive mascot selection, and their first purchase of a Supercomputer in India

These were just garnishes on The plate, despite their contribution. The actual cooking was done elsewhere. Never written down. Partly because

The purchase of India’s first Super Computer by A paint company before ISRO or DRDO is considered sexy, but it lacks the eloquence

It is common for books and case studies to be commissioned or vetted by the promoters. And fluff feels good!

The writer frequently lacks The knowledge and expertise to comprehend The business details and intricacies

According to my understanding, a group of people, mostly comprising of companies like ICI, British Paints, Goodlass Walls (Later Kansai Nerolac), and Shalimar paint makers, managed to take down Goliaths in just 2 weeks. Between 5 and 3 decades after its inception

In 1942, Asian Paints was established by four friends as a garage operation that produced low-quality paint products. By 1968/69, Asian paints had established themselves as the market leaders in India

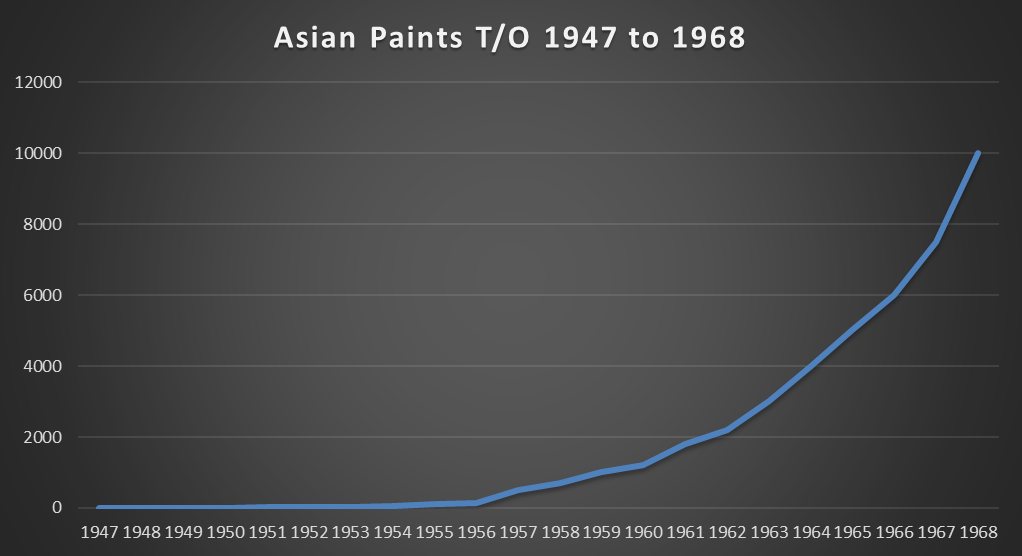

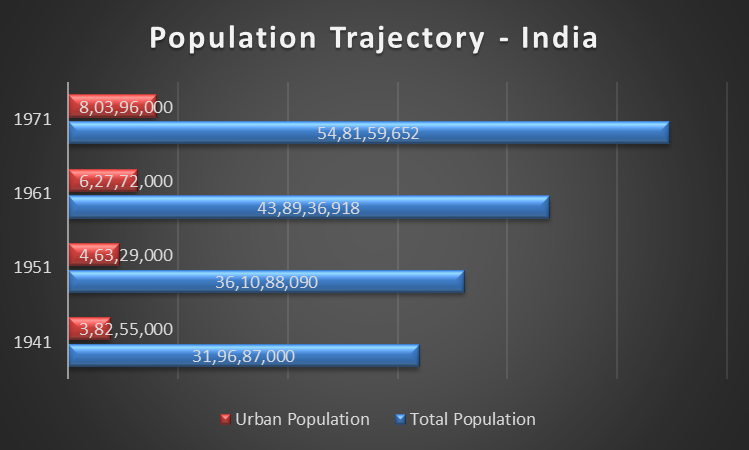

Asian Paints ‘annual turnover will be portrayed in the following chart. A hockey stick growth is a classic example

The true success story of Asian Paints is rooted in its strategic and tactical choices from 1947 to 1968 (INR 366.68) onwards. The conversion of 5 Lacs to INR 100 Cr Turnover during The 50s and 60s was a crucial turning point

The paint market in India was vastly different during that period compared to the present day

1. Limewash was the preferred alternative to Paints by most Indians, including the middle and affluent

2. Paints were a product of high prestige and only used by the upper class, but even in the 1970s, disfigured walls were considered symbols of status. Paint consumption was mainly restricted to the Urban elite

3. During the 1940s and 1950s, British companies such as ICI, Goodlass Walls (which later became Kansai Nerolac), Shalimar Paints (International Painter which eventually became Akzonoble), and Jenson Nichelson were among the major players in the Paint market. The Queens quality was maintained by importing technology and research, along with many essential raw materials and resins

IC IP aints 1950 advertisement in print

4. India’s agrarian society was subjected to brutal treatment and bruises during the 300-year reign of British rule. India’s per capita Income was calculated to be Rs. In 2024, India’s per capita Income is Rs. 299.2.12 Lacs!)

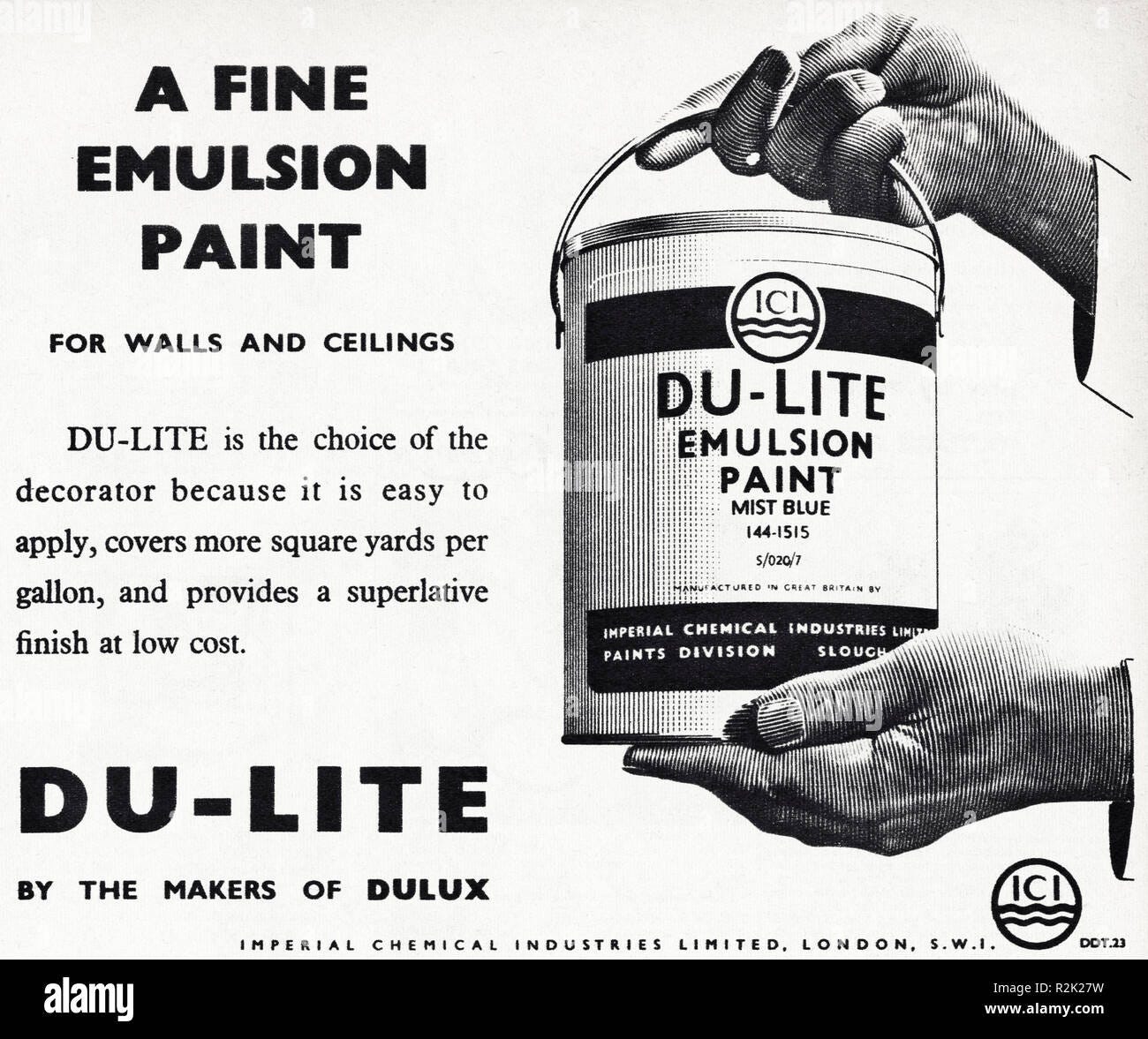

5. The number of urban centers in India with a population exceeding 1 million was NI L. T he current count is about 450

6. The distribution of paints was facilitated by super dealers who previously served as wholesalers. Dealers, who were typically located in the central markets of urban areas, distributed to both customers and smaller retailers. Previously, these dealers were at the forefront of the paint distribution value chain, possessing the majority of inventories, and maintaining applicator loyalty.)

Paint manufacturers used to offer high margins and credit to dealers in exchange for products

In the early to mid 40s, when Asian Paints was expanding its operations in the Paints market dominated by Britain, there were three crucial macroeconomic shifts happening in India

1. Resource scarcity had hit the newly independent country Stopped import Of non essential items. The categories of paints (mainly Architectural/Decorative) were grouped together. The supply chain of many British companies was torn apart by a single event. A number of them had already established a robust manufacturing sector, such as Shalimar and British. However, it caused a significant disruption in the market, creating an opportunity for the undiscovered Indian brand Asian

2. After WW2, the nation’s partition and Impact on its economy were significant Mass migration and population growth A considerable amount of people moved from rural areas to urban centers. The population census conducted in 1951 and 1961 reveal a significant increase in the number of urban centers, which is evident in both quantitative and qualitative measures. Urban areas began to develop into suburbs. The market in each suburb was designed to be distinct from the City’s “Main market.”. New distribution avenues were opened up by this

3. Augmentation in earnings and escalation in labor expenditure Has caused a disturbance in the consumer’s attitude towards “lime wash”. Distemper, which is less expensive than limewash, offers consumers significant cost savings in the medium term

The market’s preference for paints and lime-washing was influenced by this economic factor

Asian Paints was the first to enter the distribution network after established behemoths failed due to import problems, but they were unable to hold their ground once distributors such as ICI, British Painters, Goodlass Walls, and Shalimar got around the hurdle

Due to the credit comfort, the established players have a strong loyal following among the key dealers/wholesalers in the “Central Market”. The weak start up in Asia was unable to meet the credit demands of the large number of dealers

Asian Paints, which had not been able to break into the established distribution network, started spreading on the fringes of the industry. The Subarian towns and new urban centers had a growing population of small retailers, as well as smaller dealers who were ready to establish themselves

It was evidently not a strategic move, but rather one of coercion. They were not permitted to access the established distribution

Saraf Ali Amiruddin Rangwala, A prominent Goodlass Walls vendor, has his own sign. 1950.

Despite the competition from other Indian paint startups such as Mysore Paints, Varnish, and Bharat Petroleum, this decision was made with bravery and determination to remain in business

Asian was a fringe player in the mid 1940s, but their sales increased by approximately 1/10 to that of the leader

The urbanization pattern in India underwent significant macroeconomic changes during the 1950s, leading to a sudden surge in population growth. The process of urbanization led to the rise of suburbs and gradual emergence of cities

The change in consumer behavior and the increase in income proved to be more than a boon for Asian Paints, as they began moving away from Limewash

The new growth centers for paints were no longer the primary hubs of cities or the elite. Paint usage began to rise in suburbs, isolated communities, and among the middle-class population, with a much greater spread across different areas. At the pyramid’s base, it suddenly became a bustling and lucrative area

The established players opted to use their core BIG dealers as wholesalers in feeder markets rather than entering the dirty fringe market distribution:

1. Historically, the core major dealers were responsible for servicing the fringe/feeder market. The act of entering directly would involve competing with one’s own distributors and jeopardizing the relationship with influential distribution partners

2. The feeder/fringe markets would demand a significant investment in manpower and distribution, which was often uneconomic for established players due to the small number of unit offtake from these retailers compared to major dealers

The idea that distributing 50% of the cost to small dealers as dealer incentive for existing dealers could increase sales was often considered

3. Credit comfort is the basis for Paint distribution in India. The greater the distributor power, the longer the credit duration will be. Frequently fluctuating for more than a 90-day period. Due to their credit history and relationship, paint companies had developed a stronger credit comfort. Established paint companies were completely against offering similar credit to smaller and newer retailers

Credit was also granted to the retailers by larger dealers, albeit with shorter terms of 21 to 30 days

4. Paint is a product that is mass-produced and produced by breaking down the quantity into smaller batches. The process of manufacturing and selling in bulk and packaging is more cost-effective and simpler for manufacturers. To serve the feeder market, smaller retailers, and customers, major Dealers frequently repack paint from larger packaging to smaller ones, which remains a practice

To give an example, painting a standard Bedroom would require around 7 liters of emulsion for two coats. A 20 lt or 10 litres drum was the most commonly available paint size in 1947!. Previously, the dealer would give a customer 7 lts when they requested more

As previously mentioned, Asian Paints had no choice but to focus on smaller retailers and fringe markets. More driven by necessity than a calculated decision. They were compelled to adopt certain practices during the early 50s and mid 60s, which are now known as Phase 1:

The market was served by tactical demands that included: –

Have smaller packs available instead of relying on larger retailers

Manage distribution and manage the operation for multiple retail and small distribution points

Give a 21-day notice period for the distribution. The retailers were receiving credit from major dealers in accordance with their terms of payment. The credit regulation was strictly enforced, however

Due to the diverse retail distribution, Asian could implement credit discipline with ease due to its low stake per unit. The established players that provided credit to a small number of key dealers were unable to enforce strict credit discipline

Established players were based on production and supply orders, which were sent to production units. The inventory that was owned was relatively insignificant and only occasionally utilized predictive production. The prediction of demand was left to the dealer level

Asian markets opted for predictive demand forecasting and focused on measuring secondary sales and offtakes by SKU, without the need for a dealer layer

The creation of an invaluable information resource for Asians was accompanied by the need for computerized sales, demand forecasting, inventory planning, and production planning. It was subsequently transferred to the famous acquisition of India’s First supercomputer in 1970.

The decision to buy the CDC 6600, which cost 8 crs in 1970, was undoubtedly a bold move. Despite spending 5% of their turnover on hardware purchases, Asian was not the driving force behind the Goliaths’ victory. Asian had already established itself as the market leader by 1970, which was the year it happened

CDC6600 Supercomputer

Many people mistakenly attribute the rapid rise of Asians to its product innovation, which is far from the truth

The introduction of Distempers and Enamel coatings were the most significant product innovations in the industry during the 1950s and 1960s

British Paints introduced Distemper in India during the 1950s, while Goodlass Walls Painters introduced Enamel Paint to India Around the same time

The introduction of Emulsion Paints in India in the 1980s marked the beginning of technologically Asian products, which may indicate a lack of innovation. The 1940s, 50s and 60s saw Asians lacking the technological capabilities to create innovative products or focus on their areas of expertise

Asian Paints was credited with spearheading the rapid rise in Package innovation, which was driven by market demand and compulsions

Asian Paints ‘development began in Phase 3 during the early to mid 60s. The shift from Lime wash to paints is gaining momentum, housing growth has been significantly increasing, and the establishment of large PSUs in rural and non-urban areas is driving urbanization and consumption diversification in India

The time has come to recognize the success of Asian Paints in its 40s and 50s, as growth results in a decline in the hockey stick pattern

Macroeconomics played a significant role in shaping Asian distribution strategy. A distribution design that was chosen out of necessity became the primary determinant of success

The “Central Markets” in major cities gradually lost their power as new towns, suburbs, and markets with new retailers gained popularity, which resulted in a larger market presence

With decades of experience, a deep understanding of demand patterns and knowledge of the local market, Asians have established themselves in this area

The established players were unaware of the new market and had always looked down upon it

Furthermore, the contribution of Asians in establishing a retail presence, visibility in stores, and community involvement with artists was hardly ever seen before in the Indian paint Industry Brand Pull The most popular brand was Asian Paints, and it started to be stocked up on counters

Even the established big dealers were compelled to stock Asian paints due to this pull demand. The distribution value chain’s power has shifted from the big dealers to Asian Paints

The strict credit terms and price controls demanded by the Asian market brought about tangible benefits for dealers and retailers. Asians had gained expertise in forecasting demand at SKU level by the mid 60s, leading to a significant reduction in dealer inventory. Asian inventory from dealers was able to move at a faster pace due to Iits ‘pull demand and brand awareness. Despite lower margins and a reduced credit period, Asian paints offered higher returns to dealers

The most fascinating aspect was witnessing how the strict 21days credit, in contrast to others’ 90day credits, enabled Asian buyers to secure their dealer stake

Generally, paint dealers are familiar with changing the credit on a regular basis. They have the option to purchase a substantial quantity from British Paints in January with remuneration for 90 days and then sell it without paying any additional fees. Upon reaching a supply point where the dealer has overpaid, they switch to using IC IP aints and flirt with it for another 3 months before paying off the outstanding balance and selecting an additional large stock. Benefit from 180 or more days of credit in effect

In other words, the Dealer will purchase from the supplier that has clear books or no outstanding invoices

The Asians ‘shorter credit terms and stricter process compelled them to purchase more from dealers, which led to their books being cleared. The game was able to be managed thanks to the market’s pull demand, which made it necessary for dealers to use Asian Paints as an alternative

Asian Paints ‘rise was attributed to its innovative marketing and advertising strategies in TV and print media, as suggested by many fluff pieces. According to them, Gattu was a true pioneer of the epoch. There is no distance between reality and the actuality

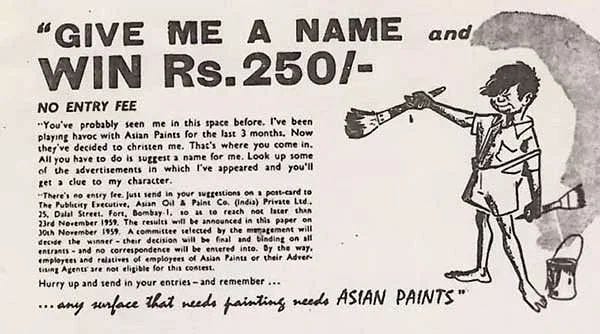

The famed Naming contest

Despite being introduced in the mid-50s, Gattu was not the most prominent symbol in Asian Paints communications until much later

Despite Asian’s print media campaign to lure consumers away from Lime wash and towards Distempers under its Tractor Distemper brand, the strategy ultimately failed. Let’s not forget about TV campaigns- India was the birthplace of Television in the 1960s, and it wasn’t until the 1980s that the Television set ventured into Rural areas

The success of Asian paints can be attributed to their distribution strategy, which was driven by market demand and positioning at the right time when macro economic indicators showed signs of decline

From my perspective, there is no evidence of flimsy “Foresightedness”, “Strategic Mind” in Choksies or the leadership in Asian art during those crucial decades that determined its destiny

The macroeconomic changes that India experienced during its 40s, 50s and 60s were beyond the capabilities of any individual or group. The impact of urbanization on the distribution system was not foreseen by anyone

The leadership of Asian paints is undeniable, with RESILIENCE and GRITTEN being the most noteworthy

During the same period as the rise of Asian markets, Two significant players entered the paint industry

1. The Mysore paint and Varnish Company was Established by the Maharaja of Mysorta in 1937. The entity, which was initially funded by the royals, lacked the resilience and perseverance to confront the Giants in the paint industry. The “smart path” was used to concentrate on niche areas, such as sealing wax and Indelible inks. The dream was small, but it persisted and was eventually taken to the national stage in 1947. Indelible inks are still being supplied by this state PSU, even to this day

2. The oil and gas giant BPCL attempted further integration with paints. Once more, it lacked the determination and perseverance to confront the opposition. A paint division was established in the 1950s as a natural progression towards integration. Initially, their primary goal was to attract large industrial customers, and they leverage the existing distributors to sell architectural paints. They quickly lost their composure and gave up. After a decade, the division eventually shut down

In conclusion:

The tale of Asian Paints ‘rapid ascent from a minor player to the dominant player in the Indian Paint industry during the period of 1947-1968 is truly captivating

It had been a journey of determination and hard work. For a company with no market share, such as Asian Paints in the 1940s, it would have been an uncomplicated solution to focus on niche markets and limit its operations, similar to its competitors from that period. Instead, it went the long way, taking the hard route and creating its own distribution from scratch. Going to do things that were loathed by the established players

At that time, Ambani was not associated with it as it was a small private partnership firm consisting of four friends, and there was no blue blood

The absence of Asian Paints was due to a lack of innovative products, marketing campaigns, and super-computers

It was a tale of perseverance that persisted until the tides reversed and markets moved in its favor

The lesson is for all future Asian Paints wannabes to learn Avoid putting the horse before the carriage. The combination of a superb IT industry, exceptional technology, innovative products, or outstanding marketing campaigns is simply fantastic. But in time

The success of a start-up will depend on the effectiveness of distribution, market composure, and resilience