How to win over investors and your board with your usage-based revenue model?

“Your revenue is not well-advised.”. ” If you run an usage-based startup, you’ve probably heard this concern from investors and board members. But many founders don’t realize: Usage-based revenue can be more attractive to investors than traditional subscriptions if framed correctly

Many valuable software companies are winning because of their usage-based models, not despite them. Investors are hunting for businesses that can grow efficiently and sustainably, sometimes forgetting that “recurring revenue (ARR) ” is only a proxy for predictable revenue. When properly presented, your usage-based model can highlight the revenue predictability they’re looking for

Once framed correctly, defensive answers about revenue predictability transform into offensive responses about growth potential and capital efficiency. Take Snowflake, which boldly declared “W EA R EN O TAS AA SM ODEL” in its IPO roadshow, turning a potential liability into a cornerstone of their $70B+ IPO success

As a former investment banker who has analyzed hundreds of revenue models, let me show you how to tell a powerful growth story that will engage investors and your board of directors to lean in rather than shy away

The Strategic Advantage of Usage-Based Revenue

The SaaS landscape is evolving, and usage-based pricing is a crucial driver of growth. According to Tomasz Tunguz at Theory Ventures, companies with significant usage-based components demonstrated ~4x stronger net dollar retention (NDR) (1). OpenView’s 2023 Saa SB enchmarks report shows that companies with usage-based pricing are 50% more likely to be in the top quartile for growth rate and efficiency (2)

Most successful companies combine usage-based elements with a baseline subscription, but the usage component drives exceptional growth. Snowflake’s S-1 filing prominently highlighted its consumption-based model and reported NDR above 160%, largely driven by expanded usage from existing customers (3). According to OpenView’s 2023 State of Usage-Based Pricing report, companies with usage-based pricing grow faster and achieve higher valuations, especially with consistent usage patterns and strong customer retention (4)

Framing Your Revenue Mix

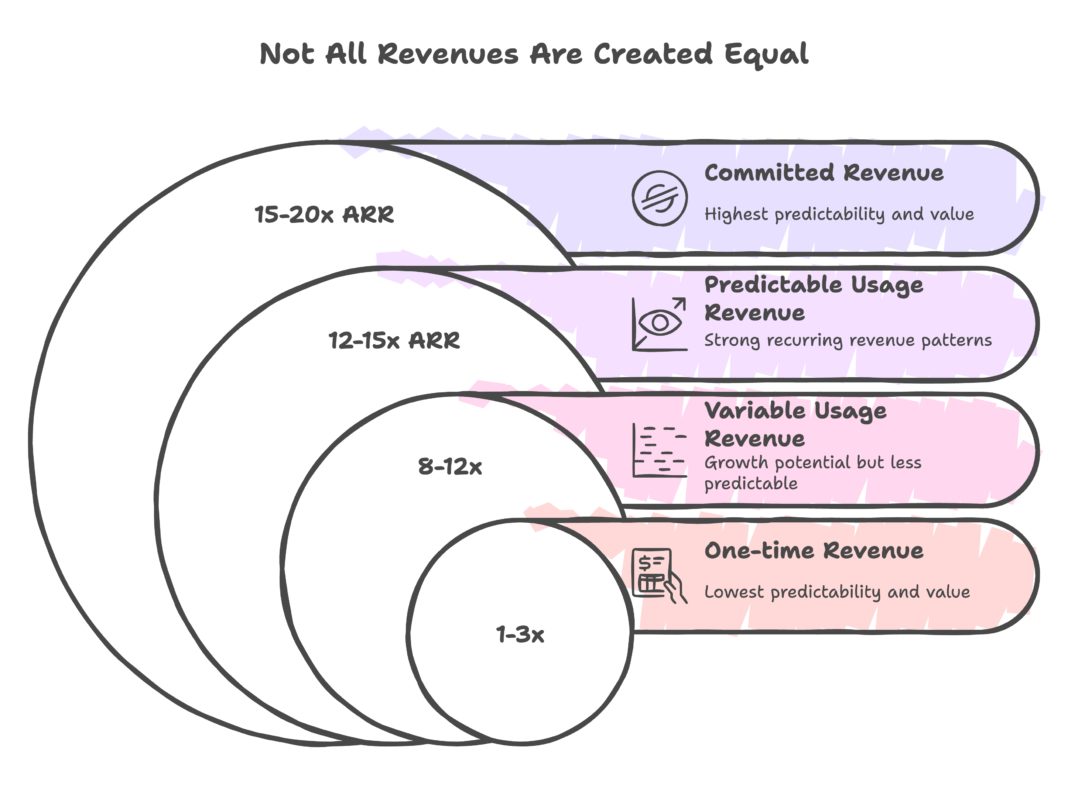

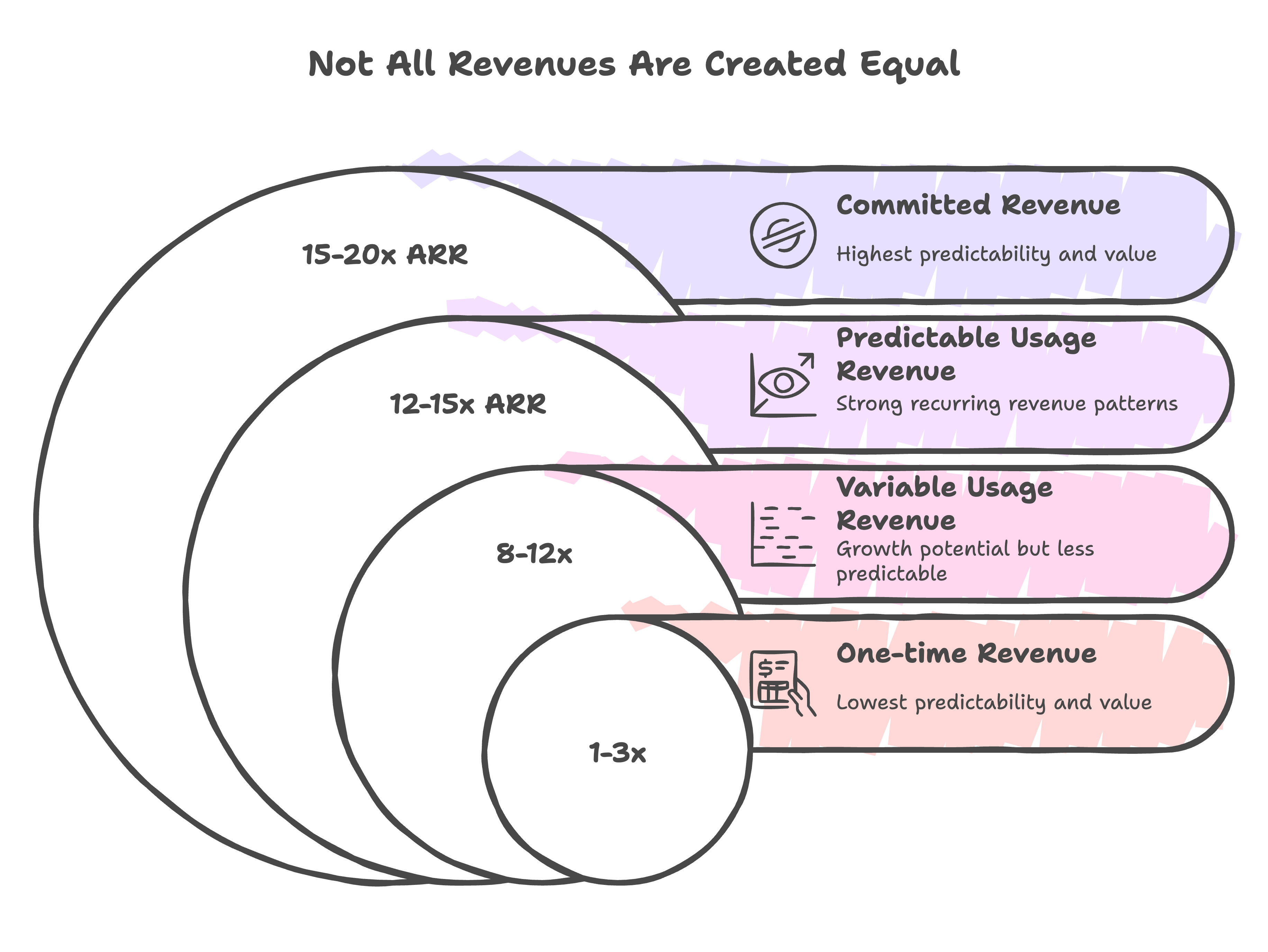

Changing the narrative around usage-based revenue starts with how you analyze and present your revenue streams. Most usage-based businesses have several revenue types that should be presented separately to investors. Here’s how to break down your revenue streams by their impact on valuation:

Source: Napkin AI

Note: These are illustrative valuation ranges only: in reality these can shift materially with market changes

1. Committed Revenue (Highest Multiple: Often valued at 15–20x ARR)

2. Predictable Usage Revenue (Strong Multiple: 12–15x ARR)

3. Variable Usage Revenue (Moderate Multiple: 8–12x ARR)

4. One-time Revenue (Lowest Multiple: 1–3x Revenue)

Pro tip: If appropriate, track and present the “graduation rates” between categories. How often does variable usage convert to predictable usage? How many customers move from minimum commitments to consistent overage? This progression tells a compelling story about your business’s maturity and growth potential

Building the Growth Narrative

The best usage-based revenue stories focus on three key elements:

Metrics That Matter

To make your case effectively, focus on these key metrics:

The Path Forward

You can transform investor skepticism into enthusiasm by focusing on usage metrics, cohort analyses, and customer behavior patterns. The key is to demonstrate that your revenue isn’t just predictable — it’s positioned for explosive growth because it’s tied to customer success

If you’re in the early stages of building an usage-based company or working on innovative pricing models, I’d love to hear from you. Feel free to reach out on LinkedIn or Twitter @simontiu — let’s continue the conversation about turning your “uncertain” revenue story into an unstoppable growth narrative

Sources: (1) Theory Ventures (2024). “ 2024 Theory Ventures GT MS urvey ” (2) OpenView (2023). “ 2023 Saa SB enchmarks Report ” (3) Snowflake (2020) Form S-1 Registration Statement (4) OpenView (2023). “ The State of Usage-Based Pricing Report ”