The Ultimate Guide to Insurance Mobile App Development for Businesses

The insurance industry is experiencing significant changes due to the digital age. The emergence of mobile technology has led to the creation of apps that allow insurance companies to more easily manage their business operations and enhance customer satisfaction. The purpose of this article is to explain the development of an insurance app, the types of apps that can be used, how digital insurance operates, and more. The objective is to serve as a comprehensive guide for companies interested in developing insurance mobile apps

What is the purpose of developing an Insurance application?

The process of building an insurance app is not merely about staying current with technological advancements; it’s about increasing efficiency, engaging with customers, improving data analytics, and positioning oneself as the strongest possible competitor in the market. The introduction of insurance apps has made them a crucial aspect of an insurance business model that is evolving with the times

Types of Insurance Apps

Insurance mobile apps are a broad category, with applications that cater to different insurance needs and market segments. Besides the consumer, agent, enterprise insurance, claim adjustment, risk management, and customer engagement apps mentioned earlier, here’s a comprehensive overview::

Vehicle insurance apps

The automotive industry is the primary beneficiary of these apps, which offer coverage for car accidents, theft, and damage. Key features include:

Property insurance apps

These apps are intended for both homeowners and renters, providing coverage for property damage caused by fires, thefts or natural disasters. They typically feature:

Health insurance apps

These apps are essential for healthcare policy management, featuring features such as::

Travel insurance apps

Travelers can access travel insurance through these apps, which are typically::

Business insurance apps

These apps are tailored to meet the needs of business owners, encompassing risks such as property damage, liability issues, and employee-related risks. Features often encompass:

Each insurance application is tailored to its specific industry, providing users with a hassle-free and efficient means of managing their insurance requirements. These apps not only offer convenience but also provide users with information and tools to help them manage their insurance claims proactively

Digital Insurance Business Model

The digital insurance business has been experiencing rapid changes due to technological advancements, increased data accessibility, and shifting consumer behavior. Take a look at the different models that are being showcased here::

These models demonstrate the industry’s shift towards utilizing data and digital platforms to create more engaging, efficient, and tailored customer experiences. In response to market shifts, they are a strategic approach that seeks to safeguard core operations and generate new revenue streams while also adapting to the demands of the digital age

Top 5 Best Insurance Apps

We’ll explore the top insurance apps that offer premium benefits and innovative features:

GEIC OM obile

GEIC OM obile, known for its impressive ratings, simplifies car insurance by providing features such as::

Lemonade

A cutting-edge home insurance app, Lemonade, delivers a seamless digital experience for homeowners:

Cuvva

Intelligent and flexible car insurance solutions are available at Cuvva:

Metromile

Metromile, the pioneer in pay-per-mile car insurance, presents an unique insurance model that incorporates usage-based features such as::

Oscar

With its intuitive app, Oscar offers a simplified view of health insurance management::

Each of these apps demonstrates how technology can enhance the insurance experience, making it more accessible and user-friendly for today’s consumers. With their pioneering work in the insurance industry, they have paved the way for other companies to follow suit

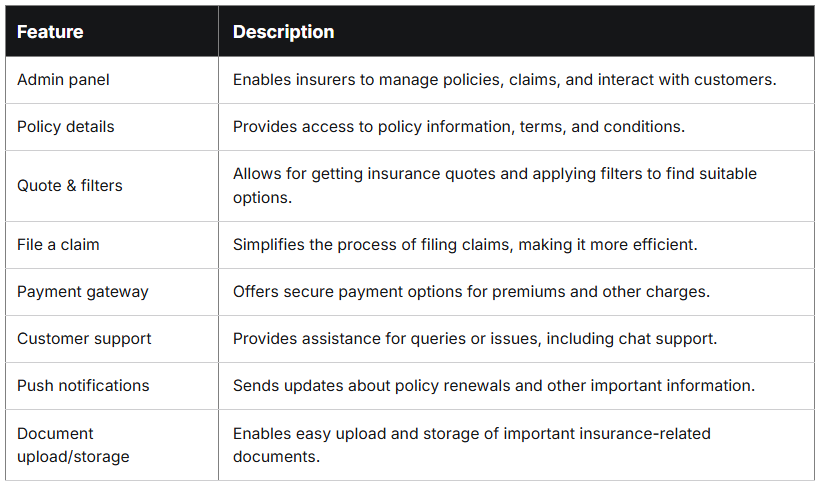

What are the top Features of an Insurance Mobile application?

The top mobile insurance apps feature a variety of enhancements designed to enhance user experience and simplify insurance management. Here’s a look at the main points::

By using these features, insurance apps can offer valuable services and enhance customer engagement and satisfaction

The Tech Stack for Developing an Insurance App

The tech stack utilized in creating an insurance app is a crucial factor that impacts its functionality, stability, scalability, and security. Key components typically include:

The incorporation of Flutter into your technology stack is essential for achieving an adaptable, secure, and user-friendly insurance What the Flutter Utilizes Flutter’s potential to meet customer demands and exceed market expectations

How to Create Insurance App

Developing a successful insurance app that not only meets market needs but also promotes the growth of your insurance business requires these steps

What is the expense of developing an Insurance App?

Depending on the complexity of the insurance application and the features included, the cost to develop it can vary significantly. The cost estimates based on app complexity are presented below, along with sample insurance apps:

Basic app

Estimated cost: $20,000 — $40,000.

Typical features: Policy viewing, basic claims processing, and payment gateway are all included in the standard features

Examples of app types:

Medium complexity app

Estimated cost: $40,000 — $80,000.

Typical features: More complex features such as chat support, custom policy alterations, integration with external APIs, and intermediate security measures are included

Examples of app types:

Highly complex app

Estimated cost: $80,000 — $200,000+

Typical features: Extensive features include AI-powered personalization, real-time analytics, advanced security protocols, IoT integration, and advanced user interfaces

Examples of app types:

Each category represents a distinct level of investment and potential user engagement. Simple apps are cheaper and faster to develop, but more complex ones offer more advanced features, better customization options, and potentially a higher return on investment through increased user engagement and satisfaction

Conclusion

The development of insurance mobile apps is a strategic requirement in today’s digital landscape. The focus is not solely on staying up-to-date with technological innovations, but also on identifying fresh opportunities in customer engagement and revenue generation. The creation of insurance apps is a complex process that necessitates an understanding of the various app types, selecting the appropriate business structure, integrating important functionalities, and picking the right technology. The investment is substantial, but it also yields significant benefits in terms of operational efficiency and customer satisfaction

For those interested in taking part this way What the Flutter Provides guidance and expertise in mobile app creation, ensuring your insurance app meets and exceeds market demand Contact us Embrace the evolution of your insurance company with an advanced mobile device apparently

If you liked this post, there are 3 ways to help support our work: 1) CLEAN this story; 2) SUBSCRIBE to future articles. To learn more about our app development services, please visit our website: Https: //flutter. Wtf/